Categories: General Information

What is a Market Maker? Enhancing Liquidity and Efficiency in Financial Markets

Discover what is a market maker, the role of market makers in financial markets, how they improve liquidity, make money, and the differences between market makers and designated market makers (DMMs).

Financial markets play a crucial role in facilitating the buying and selling of various assets, such as stocks, bonds, and currencies. To ensure smooth and efficient trading, market makers have emerged as vital participants in these markets. In this blog post, we will delve into what is a market maker, exploring their role in improving market liquidity, the mechanisms they employ to make money, and the distinction between market makers and designated market makers (DMMs).

Table of Contents

What is a Market Maker?

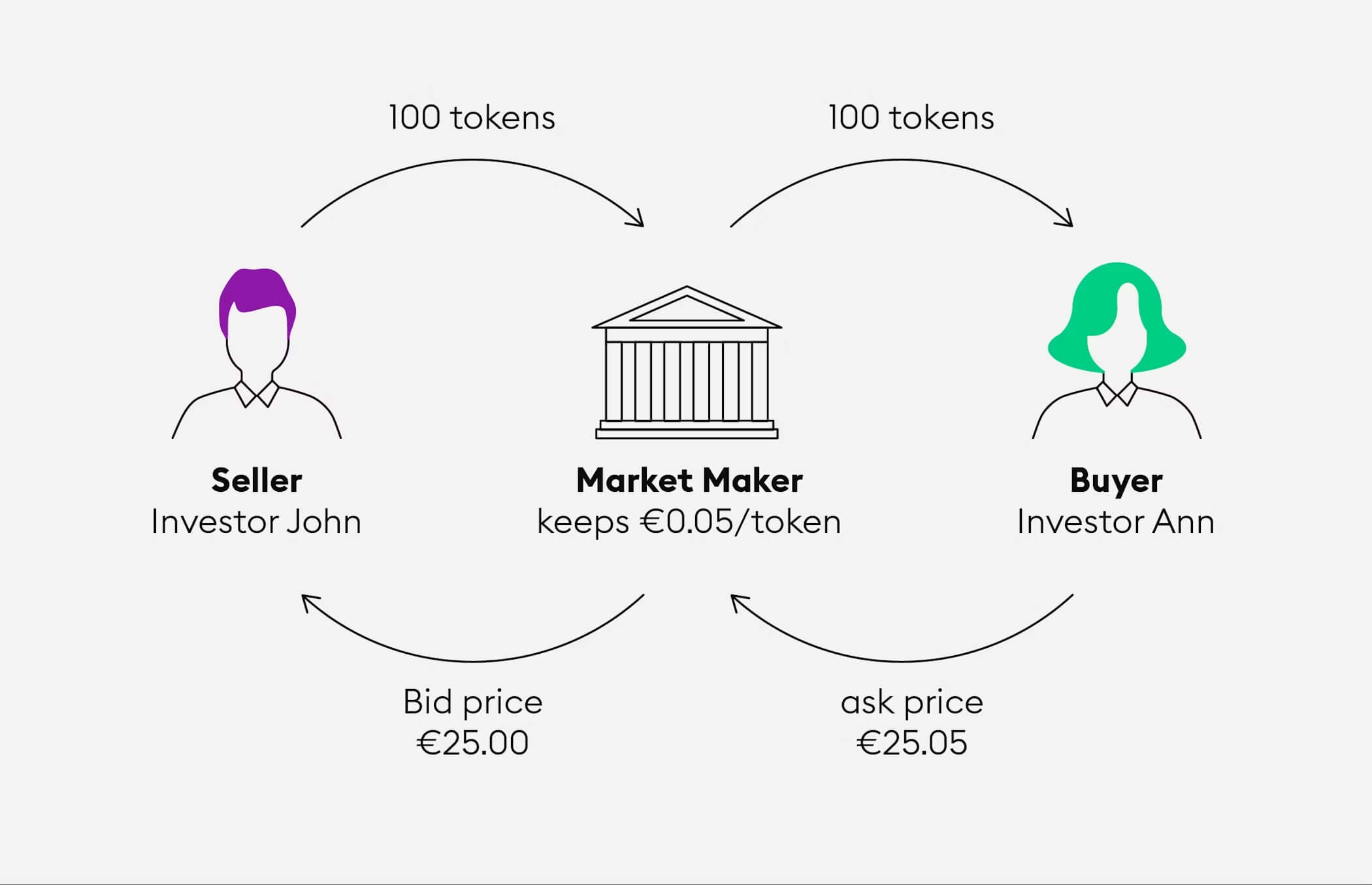

What is a market maker? A market maker is a financial institution or individual that provides liquidity to a specific financial market by buying and selling securities or other financial instruments. They stand ready to buy and sell assets at publicly quoted prices, thereby creating a continuous bid and ask spread. By doing so, market makers ensure that buyers and sellers can trade efficiently, even in the absence of other market participants.

How Market Makers Improve the Market?

Market makers contribute significantly to the functioning of financial markets in several ways:

- Enhancing Liquidity: Market makers play a pivotal role in improving market liquidity. Their constant presence and willingness to buy and sell assets ensure that there is always a counterparty available for traders, allowing for immediate execution of orders. This liquidity provision promotes market efficiency and reduces trading costs for participants.

- Narrowing Bid-Ask Spread: Market makers profit from the difference between the bid (buy) and ask (sell) prices, known as the bid-ask spread. They continuously adjust their bid and ask prices based on market conditions, seeking to maximize their profitability while narrowing the spread. This narrower spread benefits traders, as it reduces the cost of executing trades.

- Absorbing Imbalances: During periods of high trading activity, imbalances between buy and sell orders can occur, potentially disrupting market equilibrium. Market makers help absorb these imbalances by stepping in and providing liquidity to the side of the market experiencing the shortage. This stabilizes prices and prevents excessive volatility.

How Market Makers Make Money?

Market makers generate profits primarily through the bid-ask spread and by managing their trading activities effectively. Here are some key mechanisms through which market makers make money:

- Bid-Ask Spread: Market makers buy securities at the bid price and sell them at the ask price, effectively pocketing the difference. The wider the spread, the greater the potential profit. However, market makers must strike a balance between widening the spread to increase profitability and narrowing it to attract more trading volume.

- Trading Volume: Market makers rely on high trading volumes to generate profits. They aim to facilitate a large number of trades and benefit from the bid-ask spread on each transaction. By actively engaging in the market, market makers create opportunities for traders to execute orders quickly and efficiently.

- Statistical Arbitrage: Market makers employ sophisticated trading strategies, including statistical arbitrage, to capitalize on short-term price discrepancies and market inefficiencies. These strategies involve identifying patterns or statistical relationships between different securities and executing trades based on those patterns.

What are the benefits and risks of market maker?

Market makers play a crucial role in financial markets, including cryptocurrency exchanges. They provide liquidity, ensuring that there are always buyers and sellers for assets, which facilitates smooth trading. However, being a market maker involves both benefits and risks. Let's explore them:

Benefits of Market Makers:

- Liquidity Provision: Market makers provide liquidity by continuously quoting both buy and sell prices for assets. Their presence ensures that traders can execute their orders without significant price fluctuations or slippage.

- Narrow Bid-Ask Spread: Market makers aim to maintain a narrow bid-ask spread, which is the difference between the buying and selling prices of an asset. A narrow spread reduces trading costs for market participants.

- Price Stability: By actively participating in the market and adjusting their quotes based on market conditions, market makers contribute to price stability, preventing extreme price swings.

- Efficient Market Functioning: Market makers facilitate the efficient functioning of financial markets by ensuring there is constant liquidity available. This attracts more traders and investors, contributing to a vibrant market ecosystem.

- Earning Profits: Market makers can earn profits from the bid-ask spread. They buy assets at a lower price and sell them at a slightly higher price, generating a profit from each trade.

- Risk Management: Market makers manage their positions and risks carefully. They have strategies to minimize exposure to sudden market movements, reducing the likelihood of significant losses.

Risks of Market Makers:

- Market Risk: Market makers are exposed to market volatility. Sudden and significant price movements can lead to adverse price changes in their positions, resulting in potential losses.

- Liquidity Risk: In illiquid markets or during periods of extreme volatility, it may become challenging for market makers to find counterparties to match their quotes. This could result in reduced profits or increased risk.

- Competition: Market making is a competitive space, and market makers may face stiff competition from other market participants, including other market makers and algorithmic trading strategies.

- Regulatory Risks: Depending on the jurisdiction and the assets they trade, market makers may face regulatory challenges and compliance requirements, which could impact their operations.

- Counterparty Risk: Market makers may face counterparty risk when dealing with other market participants. If a counterparty fails to fulfill their obligations, it can lead to financial losses.

- System Failures: Technical glitches or system failures could disrupt market-making activities and lead to missed trading opportunities or potential losses.

Despite the risks, market makers are an integral part of financial markets, and their activities contribute to overall market efficiency and liquidity. It's essential for market makers to employ sophisticated risk management strategies and stay informed about market developments to navigate the challenges effectively.

Market Makers vs. Designated Market Makers (DMMs)

While market makers are prevalent in various financial markets, designated market makers (DMMs) are specific to stock exchanges. DMMs have additional responsibilities and obligations compared to regular market makers:

- Specialist Role: DMMs are assigned specific stocks or securities to manage on an exchange. They act as the primary market maker for those securities, providing continuous liquidity, maintaining an orderly market, and ensuring fair and efficient trading.

- Market Oversight: DMMs monitor trading activity and price movements in the stocks they oversee. They intervene in cases of excessive volatility or irregular trading patterns, employing various tools such as limit orders or short-term trading halts to stabilize the market.

- Obligations to the Exchange: DMMs have specific obligations and reporting requirements to the exchange they operate on. They must adhere to the exchange's rules and regulations and fulfill their responsibilities to ensure fair and transparent trading.

Conclusion

Market makers are essential participants in financial markets, enhancing liquidity, reducing trading costs, and improving market efficiency. Through their continuous presence and willingness to buy and sell assets, market makers ensure a seamless trading experience for buyers and sellers. By understanding what is a market maker, their role and the mechanisms they employ to generate profits, traders can better navigate the complexities of financial markets. Follow U2U for more blockchain information.